Zillow and Redfin both use algorithms to estimate the value of your home. BUT, their estimates can vary dramatically from each other. Who has the better algorithm?

Zillow says my home is worth $61,000 more than Redfin says it’s worth.

Which one of them is right?

The truth is, sometimes these digital estimates can be pretty accurate. And sometimes they’re just…not.

Today I’m going to uncover the secret algorithms that help Zillow and Redfin estimate the sale price of a home. I’ll show you what they’re doing right, and then I’ll show you 4 limitations of their algorithm that prevents them from being accurate most of the time.

Then you can learn how to estimate the price of your own home as you watch me estimate the price of my home, to see how much it’s really worth, and whether Redfin or Zillow got it closer.

How the Algorithm Works

Zillow says this about their Zestimate:

In my town, the median home price for homes that closed over the last 30 days is $629,000.

If their Zestimate was within 20% of value, that would mean it was $125,000 off. That’s nothing to sneeze at. However, that’s when you’re looking at 99% of properties.

A reasonable number of homes came within 5% of the Zillow Zestimate when they sold. How accurate they are varies by city.

In my metro area, Raleigh, 85% of listings sold within 5% of the Zestimate. The median home in Raleigh sold for $415,000, so that means the Zestimate would have been about $21,000 off. For my suburb of Raleigh, it would have been about $31,000 off.

Now, let’s take a look at Redfin. Are they any closer?

Redfin’s Algorithm

According to Redfin, they say their estimates are much more accurate than Zillow.

Half of homes that sold came within 2.1% of the Redfin estimate. The other 50% were much further off. Similar to Zillow, 97% of homes that sold came within 20% of their estimate.

How do you know if the Redfin Estimate or the Zillow Zestimate is accurate for your home?

There are four reasons that these pricing estimates are so rarely accurate. But these are things that you can adjust for on your own, if you know what to look for. So let’s take a look at the limitations of these estimates.

And just for reference, if I look at all the listings I’ve personally sold as a Realtor, my listings have sold with less than a 1% difference of my initial sales price. And that’s for 100% of my closed sales. For the time being, a human can still really estimate the value of a property much more accurately than an AI model. Let me show you what to look for.

What They’re Doing Right

Let’s look at the Zestimate and the Redfin Estimate for my personal property, so I can show you what the algorithm does correctly.

Zillow says my personal home is worth $637,000, and Redfin says it’s worth $576,000.

First let’s look at the comps they used to come to those numbers.

Limitation 1 – Knowing Which Comps to Use

Maybe you’ve heard the word “comp” before. If not, just know it Realtor slang for a comparable home.

Knowing which comps to use and which to leave off is a really important step in getting the right price.

A truly comparable home is the type of home that someone looking at your house is likely to also consider.

So if a house is a lot smaller or a lot bigger, it’s not really a comp. I can’t take a 1,000 square foot house and just make a square footage adjustment for a 3,000 square foot house. This is true even if they are in the same neighborhood. Because, someone looking at a 1,000 square foot house probably isn’t also looking at 3,000 square foot homes.

There is some flexibility, but this is true even for styles of homes. I really don’t like using a one level home as a comp for a 2 story. Because many people looking for one level homes, won’t consider a 2 story. Now I will use it if there is nothing else to choose from, especially if it’s in the same neighborhood.

But the less similar your comps are from the subject property, your home, the less reliable your pricing is.

Why Zillow and Redfin used Different Comps

So let’s look at why Zillow and Redfin came up with almost completely different comps, and I’ll show you which homes I would have left out of the mix.

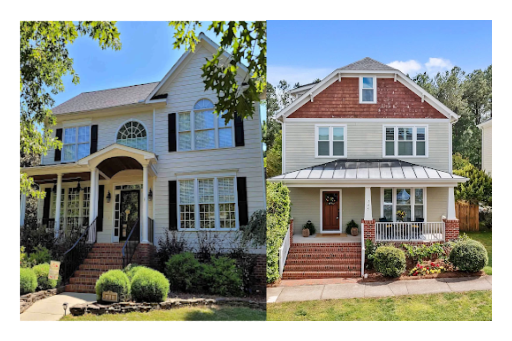

The home on the left is a fantastic comp, although there are a few differences I might adjust for.

But it’s very close in proximity. Similar exterior finishes. The interior finishes are inferior, but I still think this one is a perfect comp because I definitely think anyone looking at my home would also look at this one.

Redfin and Zillow also both used the home on the right.

Now I don’t love this home as a comp. The reason I don’t love it is because this section of this neighborhood, the lots are about half the size as my neighborhood and the other good comps. While this is a single family home, the lack of yard makes it live like a townhome.

How a home lives can make it a bad comp.

There are some people who would consider this home and my home, but there are many who just wouldn’t.

If you have kids or dogs, this yard is likely going to be an issue for you.

Having said that, if there was nothing else to use, I would use it, but I would take it with a big grain of salt when determining what my home would likely sell for. Because I think a home on a ¼ acre lot would have much more competition than this type of home on a zero lot line. At least in my area it would. Remember, the key to choosing comps is whether a buyer would consider this home alongside your home when they are shopping.

Now, when we look at comps that were exclusive to each company, I think a key idea in the algorithm is revealed.

Redfin favors more recently closed homes, and Zillow favors much older homes.

Redfin has three homes in their comp list that closed within the last month. Zillow didn’t use those, but they did use 2 homes that closed almost a year ago. I understand why Redfin would choose those 30 day old comps. They’re fresh and have the best likelihood of being good comps. But why would Zillow use comps that are a year old?

Both of these selections show the additional two limitations of AI home pricing. Let’s look at Redfin first.

Limitation 2 – No Access to Surrounding Area

One of the comps that Redfin used that sold within the last month looks on the surface to be a fantastic comp.

It sold less than a month ago. It’s a similar size and it’s right in my neighborhood.

It’s even on my street. But it’s actually not a good comp.

What Redfin didn’t know is that this house is one door over from a major construction project. The main street at the top of my neighborhood is having a roundabout put in. They ripped out the entire front of our neighborhood. The entire street is a construction zone and the project won’t be done until 2025.

Because of this, that house was going to be hard to sell.

As a matter of fact, the previous owners sold it to Open Door, because they knew it was not going to fly off the market with all that construction happening. After Open Door bought it, it sat on the market for 123 days. The median number of days it takes to sell in this area is 5.

This is not a comp because it’s an unusual circumstance. I would have removed it from my list and not used it. So that’s another limitation of using AI to price homes. They can’t look down the street and things that might cause something to sell more slowly or for less money. At least not yet.

Limitation 3 – Zillow’s Marketing Strategy

Okay, now let’s look at the older Zillow comps.

One in particular was sold 10 months ago. And I’ll tell you why I think they used it.

Zillow is a marketing company. That’s what they are.

You think they’re a tech company. You think they’re a real estate company. They’re not. They built a tool that gets people to click and then they sell those people (buyers and sellers) to Realtors. That’s it.

They want you to think that your property is worth so much money, because they want you to call them so they can give your information to a Realtor and then the Realtor pays them.

That’s their business.

Here’s an interesting thing. Sometimes buyers will call me and say “Hey I saw this property on Zillow,” and when I pull it up, it’s already sold. They do that with really hot properties because they get more calls on the hot properties.

Now most of their listings, maybe 70-80%, will accurately reflect if the property is still available. But those properties that look really great, great location fantastic price, they keep those active even after they close. Because those properties bring in more calls.

And being a marketing company is a limitation in getting accurate Zestimates. Because accurate Zestimates bring in fewer calls. One of the older comps they used sold for $745,000. It looks like they used it just to get the price up on my home.

Limitation 4 – Cheap Construction

There’s one more of the Redfin comps that I think is a terrible comp, and shows another limitation of the AI pricing model.

The house with the hand pointing at it is what we call a production home.

It’s built of cheaper materials. It has vinyl siding, The finishes are much less expensive. It’s got a textured ceiling, which is what they use to cover over rushed drywalling jobs.

It was probably built by KB Homes or one of the other lower end builders. There’s nothing wrong with these builders. My first home was more along these lines. They provide a good product for buyers at different price points. But it’s not the same product as what you see in the other comps.

The homes in my neighborhood and surrounding neighborhoods are all custom or semi custom homes with higher end finishes and more complicated architecture, which costs more to build. Using a production home to help price a custom home will give you a lower estimate for the custom home than it deserves.

AVOID THE MOST COMMON HOMEBUYER NIGHTMARES

Our FREE PDF, Common Homebuyer Nightmares and How to Avoid Them! tells you everything you need to know.

Conclusion

At least in this case, I think both of the AI prices are wrong.

The Zillow Zestimate is way too high and I think the Redfin estimate is way too low.

This is what I would have done to determine the probable sale price.

I would have used comps 1, 3 and 5 from Redfin’s list. And then I would add in Comp 1 from Zillow’s list. Then I would make a few adjustments for things that were nicer in these properties than in my home. One property had a completely new kitchen and bathroom, so I made an adjustment since my home doesn’t have those. A couple of them had really large yards, so I made an adjustment to account for that as well. Other than that, they were pretty similar!

The Redfin price was $40,000 too low. And the Zillow price was $20,000 too high.

If you enjoyed this article, you might also like this one, where I crunch the numbers to determine the best month to buy a home in the Triangle!