Last week, someone made this comment on my channel.

They said, “Look for prices to come down nationally by 40-50% by 2027….the market always corrects.”

And it makes sense that a lot of people think this. Look at the headlines from this week. Incomes are Falling, Average Household Debt is over $10,000 and Baby Boomers are falling into homelessness. If these things are true, how can Americans afford home prices this high?

But there is a huge piece of data that no news source is talking about. And this secret information that I’m about to share with you, turns the economic picture on its head.

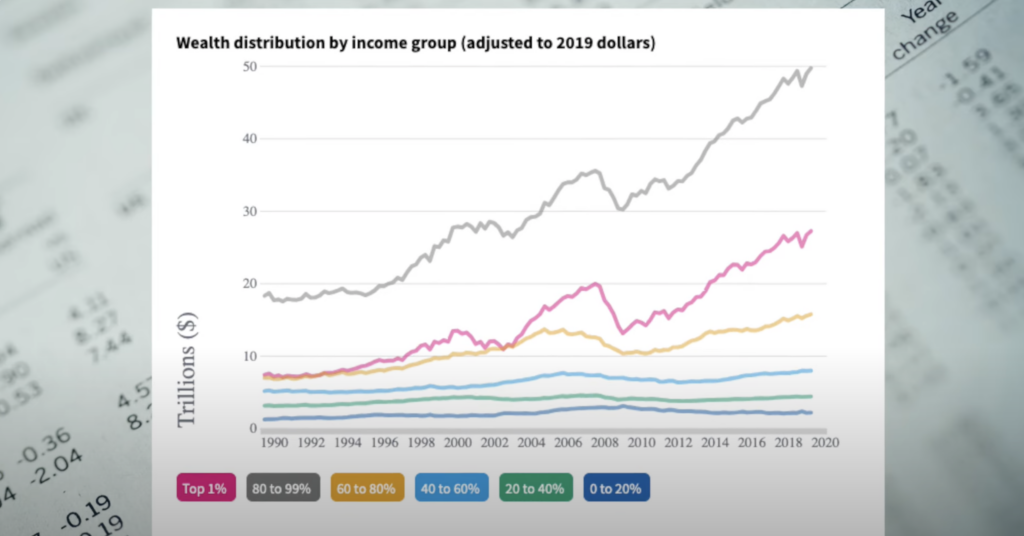

Look at this graph. This shows the growing wealth by income levels.

The top three lines represent the top 50%….and they have doubled their wealth over the last 30 years.

We’re going to look at three puzzle pieces that will help us understand what could happen in the future with the housing market:

- If people’s incomes are dropping, how is their wealth growing?

- How much wealth does a typical American in the top 50% have?

- Do they have enough wealth to support the price of housing in today’s market?

Finding the answers to these three things will help us understand whether we’re really going to see home prices decrease up to 50%.

Puzzle Piece #1: How are people getting richer?

“Housing prices are completely out of line with wages. Wages have not kept up with house prices.”

If wages are going down…how are the top 50% getting richer?

Well it turns out, people are giving up on earning wages as a way to support themselves.

In increasing numbers, people’s money isn’t coming from wages, it’s coming from starting their own businesses. Looking at wage growth isn’t telling us how much money people actually have.

US Business formation grew by 42% in 2020. Some of those businesses didn’t last, but the pandemic started a huge shift in how people work, and most of us don’t realize how big this has gotten over the last 3 years and the impacts it is having on our economy.

The number of independent workers has grown from 38 million in 2020 to 64 million in 2022.

For the record, independent workers income is considered business income, not wages. So the talk about stagnating wages is not taking this phenomenon into consideration.

Americans love their side-hustle

Many of these independent workers are still working a main job while also working a side hustle. You might be tempted to believe that people working side hustles are doing it because they are forced to to make ends meet. But in most cases you would be wrong. MBO Partners, an expert in the Independent Workforce, had this to say about independent workers:

Independents are becoming larger in number, more centered in the economy, more connected to one another and to companies large and small.

They find work in different ways even from a few years ago and have a fundamentally optimistic view about their own prospects, their health, and their purpose.

In a survey, 76% of people with a side hustle said they love their independent work, compared to 51% of people who claim to love their full time job.

A survey of small business owners earning over 6 figures showed that 81% of them started their business as a side hustle.

It appears that many people with a side hustle hope to turn it into a full time business. 43% of full time workers say they have a side hustle. And for earners over $100,000/year, 62% of workers said they had some kind of additional income outside of wages.

Wages just aren’t telling the full story.

Side hustles bring in $50 billion dollars a MONTH in additional income for Americans. When a lot of people think of gig work, they think of selling on Etsy or being an Uber driver or maybe starting a podcast. But the truth is professionals make up a huge portion of the Gig economy.

I regularly hire gig workers to do graphic design, web design, coding, to set up automations for me, to do video editing. I’ve watched Independent workers that I have hired over the last few years become successful businesses as they got busy and brought on junior creators under them to learn whatever craft they were performing.

Companies like Fiverr and Upwork have made it easy for professionals to become independent workers, to work side gigs and eventually branch off into their own business. The fact is, starting a business has never been more accessible to Americans at any time in history as it is right now. And they are doing it in record numbers.

But how much money are they making? Let’s look at puzzle piece number 2.

Puzzle Piece #2: How much money?

5% of side hustlers make over $10,000/month.

5% may not seem like that many people, but according to Yahoo Finance, 50% of all Americans have a side hustle.

That means 3.9 million people are earning $10k/month or more with their side hustle.

That’s in addition to their regular job. And 31%, or 19 million people, earn between $1000 and $5000/month.

Remember, this is extra, in addition to their wages, which are not keeping up with inflation. And remember wage stats are not taking this income into consideration when analyzing housing affordability.

But this isn’t even how the majority of Americans are growing wealth. Private businesses are only a very small share of the wealth held by Americans in this income group.

In this graph, the majority of wealth for Americans in the 40th to the 90th percentile is held in real estate. But since the value of that real estate is what we are questioning, let’s ignore that and focus on the other things.

Durable Goods are the next group. That’s your vehicles, home appliances, jewelry, electronics.

And after that it’s stock ownership.

Stocks owned by this group of Americans has grown by 10.5 times since 1990. In 1989 the median retirement account held 22,000. That would mean those Americans currently hold $231,000 in stocks and mutual funds.

Doing the Math on American Wealth

We’re going to do some math here, so just hang on to your hat.

There are 135 million people in the American workforce. 40% of those Americans earn wages and hold wealth in this 50-90th percentile. That’s 54 million people.

It’s very difficult to figure out how much wealth the average person has because it’s a moving target. But I think looking at this graph we can estimate about 65 trillion in total wealth for the 50th- 90th percentile of income earners.

If we divide that wealth by the number of people in that group we get an average of $481,000 each. And the average household income of this top group of people is 133,000/year.

Now this is not an exact science. It would be impossible to figure out these exact numbers. But this rough idea is enough to move forward onto the final piece of the puzzle.

We need to know whether the wealth this group of Americans holds can sustain the current housing market prices.

Dust off your grade school word problem hat because we’re gonna do a little more math.

Not enough houses means not everyone gets one.

If the average person buys or sells a home every 10 years that means this group in the 50th-90th percentile would buy 5.4 million homes every year.

You’ll notice that more homes were sold during 2005 and 2006. That was a part of the reason the housing market crashed. Because builders overbuilt for the population. But the population has grown. More people need houses now than they did then, and builders haven’t built them.

My point here is, in our current economy and with the average inventory over 10 years, it doesn’t appear that the bottom 50% not being able to afford homes will impact the price of housing. Because the housing inventory isn’t big enough to support all Americans.

Right now it is only big enough to support the top 50%. And they can afford these prices. I’m not saying there definitely will not be a housing crash. I’m just saying that I can’t find evidence in the math of it. It’s possible that I just don’t have all the data. If you’re aware of a data set that I have missed or not considered please do share it in the comments.

A Housing Crash won’t solve the Affordability Problem

Because the reason ALL of this is important, is that in order to make homes affordable for the average person, we have to understand WHY they are not affordable.

If you came into this video not understanding why economists are shouting so loudly about inventory, does it make more sense now?

We cannot depend on a housing crash to make homes affordable for the average person.

We absolutely must build more houses to get the prices down. And to do that, we need fewer people shouting about housing crashes and more people strategizing ways to get more homes built.