What can we expect from Raleigh’s housing market in 2024?

Most are predicting a return to some kind of normalcy with lower mortgage rates on the horizon. But to understand what might come next, we need to understand why 2023 was such an odd year for real estate.

Historic Changes in Raleigh’s Housing Market

Over the past three years, we have seen a circus of a housing market.

First, interest rates dropped to the lowest we have ever seen in history. Buyers bought homes in record numbers, and sellers refinanced to the lower rates.

Then, when things got too overheated, the Federal Reserve raised interest rates, causing a significant slowdown both in buyer purchases and seller listings.

After two and a half years of interest rates rising, we’ve finally seen rates drop, currently a full point below their peak. The Fed has penciled in three rate cuts in 2024, but some investors are expecting six.

What does this all mean for Raleigh’s housing market in 2024?

In a normal world, two things should happen.

What Could Happen in the 2024 Raleigh Housing Market.

First, lower mortgage rates should incentivize sellers to list their homes.

And, secondly, buyers who have been sitting on the sidelines should finally be able to jump into the housing market now that rates are more affordable.

Most people are predicting this.

But how far will it go? There are three possibilities:

- – the market gets oversaturated with homes for sale, causing prices to drop,

- – more buyers jump into the market and start bidding up the prices again, or

- – we level out into a normal market.

Will we have more sellers than buyers, causing prices to deflate after years of inflation? Or will we still have more buyers than sellers, causing buyers to compete over homes for sale and prices continue to go up? Or will it be somewhere in the middle, with relatively flat real estate prices?

We can’t know exactly what is going to happen, because my crystal ball is still in the shop, but there are three clues that will tell us a lot about what might happen in the Raleigh real estate market this year.

How We’re Going to Figure it Out

Like any other market, real estate prices are driven by supply and demand.

So, we’ve got to look at both sides of that equation.

It’s all about supply and demand

We’re going to start with demand. How many people are going to move into the area? How much pent up demand is there for people already here in Raleigh and ready to buy?

Then we’re going to look at the supply side.

How many people are going to be listing their homes and leaving the area (we don’t increase inventory with sellers who stay in the area), and how much new inventory will builders be able to provide?

First, we’re going to look at the ratio of people who move into the market compared to those who move out of the market. Because if a seller lists their home, and then buys another one in the same area, it’s just a net zero for housing market inventory. They wouldn’t be providing a home to people moving into the area, or to first time buyers. We want to know how many are actually staying in the area, compared to those who are moving away.

The second thing we’re going to look at it is how much pent up buyer demand there is. How many people have been sitting and waiting to buy a home? And how many of them can afford today’s prices?

The third thing we’ll look at is, how much new home inventory is there? Those three clues should give us a pretty good idea of what the housing market will do in Raleigh in 2024.

Before we look at the first clue of where the housing market is headed in 2024, let’s do a quick recap of what happened in 2023.

How 2023 Was Different From Previous Years

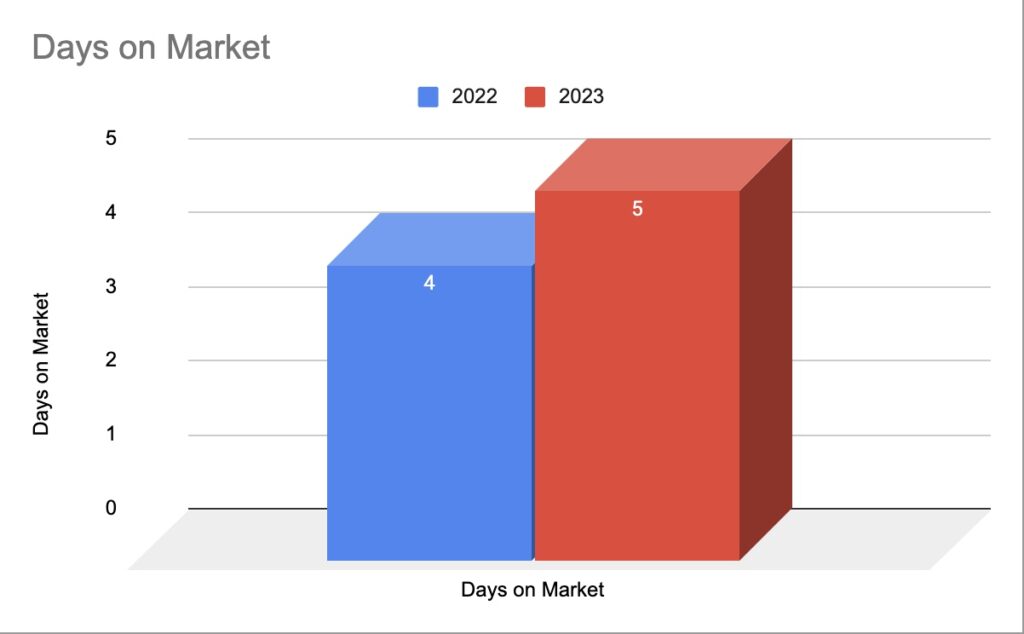

In 2023, we sold 17% fewer homes than the previous year.

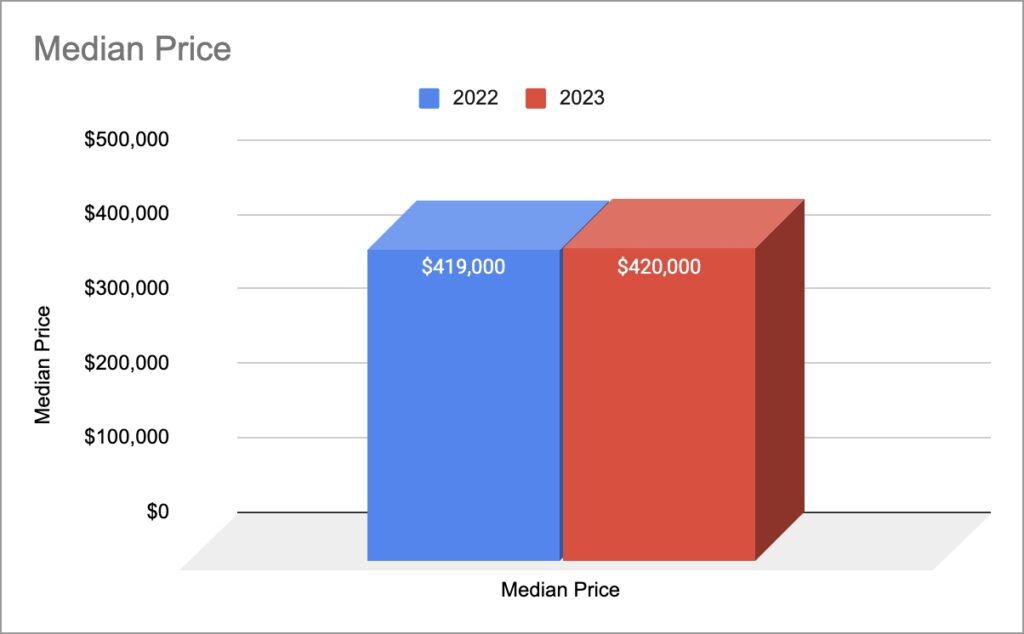

The median home price stayed about the same in Raleigh as the previous year.

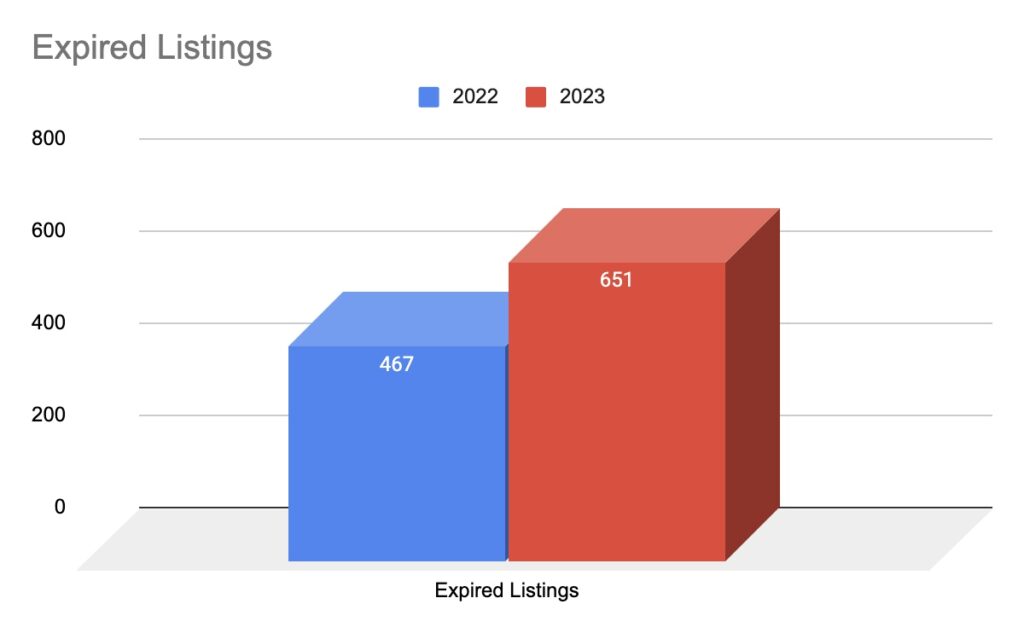

Expired listings increased by 39%, and 2% more listings had competing offers than the previous year.

A couple important things to note. Usually when we see expired listings, this can be a sign of a shifting market. That is what happened in 2008…people were listing their homes then they suddenly stopped selling, and the listings expired without selling. But, you have to look at the whole picture. In this case, at the same time as we’re seeing more expired listings, we’re also seeing a bigger percentage of competing offers.

One explanation that I think is feasible, is that with the higher interest rates and higher cost of purchase, buyers are less willing to buy homes that haven’t been well maintained, or aren’t presented to the market well.

If buyers are still willing to compete for the good homes, it’s unlikely that properties are expiring because there aren’t buyers willing to buy them. If you’d like to see this information for all the cities in the Triangle, here’s an article that provides an overview of the market in 2023.

Let’s take a look at the first clue to see what 2024’s market will look like.

(Chart goes here- Timothy- I can’t figure out how to get a new chart in this block, but if you can add the space, I’ll put the #s in!)

2024 Clue #1: Number of Buyers in the Raleigh Housing Market in 2024

The first clue is the number of home buyers moving into the area, and the number moving out.

Many economists are saying that 2024 is the year sellers will finally list their homes. And it makes sense. 61% of mortgage holders have rates under 4%. Usually, when you own a home and sell it to move into a bigger one, the first home gives you a nice nest egg to put toward the next one, and you’ll spend a little bit more, but not that much. But in 2023, that system was really out of balance.

Let me show you what I mean.

Why People Didn’t Sell Their Homes in 2023, Why Inventory Was Down

Let’s say you wanted to move up in 2023, you bought a home in Raleigh ten years ago in 2013.

Ten years is about the average time people stay in a home.

2023 Example

You paid the median home price, which was $200,000 at that time. The mortgage rate at that time was about 4%, making your payment about $1,266 if you put 5% down. If you refinanced when rates dropped into the 2%s, you’re only paying $1,000/month. At that time, for that price, a typical home was about 1,800 square feet with 3 bedrooms and 3 bathrooms.

Now, you’ve had a couple of kids, you and your spouse are both working from home and you need more space. So you want to buy a 28,00 square foot house, with 4 bedrooms and two living spaces. And you want a pool community, so your kids can be on the swim team.

The median price for that home in 2023 is going to set you back $678,000 in Raleigh. And you’re thinking that’s no big deal, our current home is worth $450,000 now, and we only owe $100k on it. Minus moving expenses, closing costs and listing fees, we’ve got about $300,000. We’ll have a $378,000 mortgage, that’s not much more than our previous home!

But the mortgage payment at 7.5% interest is $3,100. Triple what you’re paying now. That’s going to make a lot of people say it isn’t worth it.

A 2013 Example: why things were different back

But here’s the crazy thing, and why that scenario isn’t normal.

Let’s say you bought that same house in 2003, instead of 2013.

You paid $167,000 for it back then, and your mortgage payment is about $1,220.

And then 10 years later, in 2013, you moved up into the same bigger house, with 4 bedrooms and 2800 square feet. That move up home would have been $393,000 at that time. But your old house has only appreciated $33,000 over the 10 years between 2003 and 2013. So you don’t have much to put down, let’s say only $20,000.

But in that scenario, even with hardly any equity, your new mortgage payment is only $2,400, about twice what your old mortgage payment was, not three times.

This is what I mean when I say most sellers have been locked into their homes, even though their property values have increased so much. Between inflation increasing the general cost of living, and the cost of moving up to a home triple their current home cost, it’s just not worth it for many people.

But now, with rates coming down, that new home in the same scenario we talked about is going to cost $2,700, not $3,100.

It might not be great, but it’s getting better.

And the better rates, that are expected to get even better, are starting to entice people. So, economists think people will be listing many more homes this year.

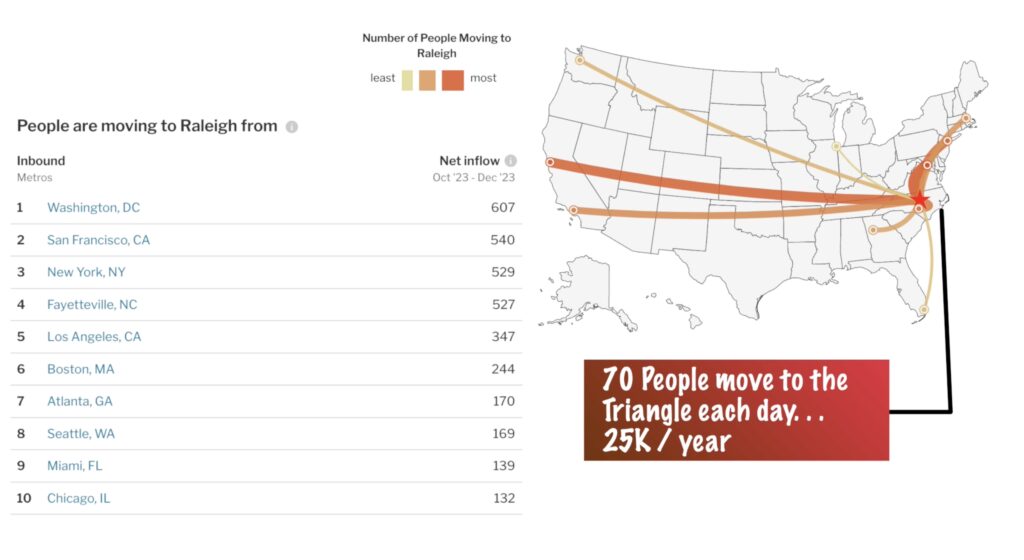

How Many People are Moving into the Raleigh Area vs. How Many People are Leaving the Raleigh Area?

Just knowing that there will be more listings doesn’t tell us everything we need to know.

Because if you’re listing a home and buying another one, this is a net zero on the housing market. We need to know how many of these homeowners are staying in the Raleigh area and how many of them are moving to a new metro area. To determine that, I looked at two things.

Redfin Data

First, we can use some Redfin data. Redfin measures how many people searching on their website are looking to stay in their current city or move to a new city. Back in 2017 when Redfin started keeping track, about 15% of buyers were looking to relocate. In 2023, that number is 26%. And Raleigh is about equal to the national average.

26% of people currently living in Raleigh, searching for homes on Redfin’s site, are looking at a different metro area. But last year, only 20% of people living in Raleigh were looking to leave. So that tells us something.

More people are looking to leave Raleigh today than last year. If you look at the cities people leave Raleigh for, you’ll see that they are almost always cheaper, like Myrtle Beach, Greensboro, or Rocky Mount, with median home prices almost half of our prices in Raleigh. Or they are different lifestyles like mountain or coastal towns.

So, it seems that prices have gotten to the point that some people in Raleigh are looking to move to more affordable locations. Or, they’re looking to retire outside the area.

United Van Lines Survey

Another thing we can look at is the United Van Lines National Movers Survey. In 2023, 60.1% of moves were moving into the state, and 39.9% of moves were moving out of the state. So while people currently living in Raleigh might be looking to move out, way more people are actually moving into the state than moving out of it. And this ratio of people moving in to people moving out has stayed relatively stable over the last 4 years. It’s always been about a 60/40 split.

This makes sense, because economists believe our economy is really insulated from the slowing national economy.

Why people are choosing to move into the Raleigh housing market

Tom Barkin, president of the Federal Reserve Bank of Richmond, told guests recently at the annual Raleigh Chamber economic forecast event:

“I think the Raleigh metropolitan area has been one of the bright spots — certainly in my district, I think in the national economy.”

Sarah House, managing director and senior economist for Wells Fargo Corporate & Investment Banking, agreed, saying, “Overall we continue to see labor force growth stronger than the national picture, and that is consistent with the Raleigh metro area continuing to outperform the national economy.”

So some people are leaving Raleigh for cheaper pastures. And even more people are moving into Raleigh for jobs in our strong economy.

But what about people living here in the Raleigh area? How many are here waiting for conditions to be right to buy homes in the Triangle?

Let’s look at pent up buyer demand to see how many people are waiting on the sidelines.

Clue #2: Pent up buyer demand: Who can afford a house in the Raleigh Housing Market in 2024?

In a new report, the National Association of Realtors identified the cities with the most pent up buyer demand.

They calculated this by using several different criteria. The NAR looked at the number of households able to afford the median priced home at a 6.5% mortgage rate, compared to a 7.5% mortgage rate across the 100 largest metros.

They looked for:

- Cities that had a higher percentage of renters who could afford to buy a home at the median price.

- Places where sellers had stayed in their homes for longer than the national average. This could mean more sellers are ready to sell their homes.

- Cities with more affordable listings for first time buyers.

- Job growth that outperformed the national numbers, income growth that outperformed the national average,

- Cities that had lower crime rates than the national average.

Durham/Chapel Hill came in #4 in cities with most pent up buyer demand.

So, we’ve got more sellers likely to sell in the Triangle. We’ve got more buyers who can afford to buy homes in the Triangle. Raleigh’s got a great economy outperforming the national economy. Now we need to know if we’re able to build enough homes for all these people moving to the Triangle and moving out of rental properties. Let’s look at clue number three, new construction data.

Clue #3: How Many New Homes are Being Built? New Construction Per Capita in Raleigh

Here is a new report that’s really interesting. A lot of building start reports show the raw numbers, but not how that applies to the population. For example, L.A. is building a ton of new homes, but it’s not nearly enough for the size of their population. This report pulled from the census bureau, HUD, and their own internal moving data, to identify the top 20 cities with the most new construction per capita.

Raleigh is #11 on the top 20 cities for most new construction homes under construction per capita.

Conclusions about the Raleigh Housing Market in 2024:

Conclusion #1: All Signs Point to More Activity

Again, no one can really KNOW what’s going to happen, but the clues seem to indicate a much more active real estate market in Raleigh in 2024. Will it be a buyer’s market or a seller’s market, or will it be more balanced?

Conclusion #2: All Signs Point to it Remaining a Seller’s Market

We call it a buyer’s market, where the buyer has more leverage because there are a lot of homes to choose from, and not that many buyers shopping.

That usually means there is more than 6 months of housing inventory.

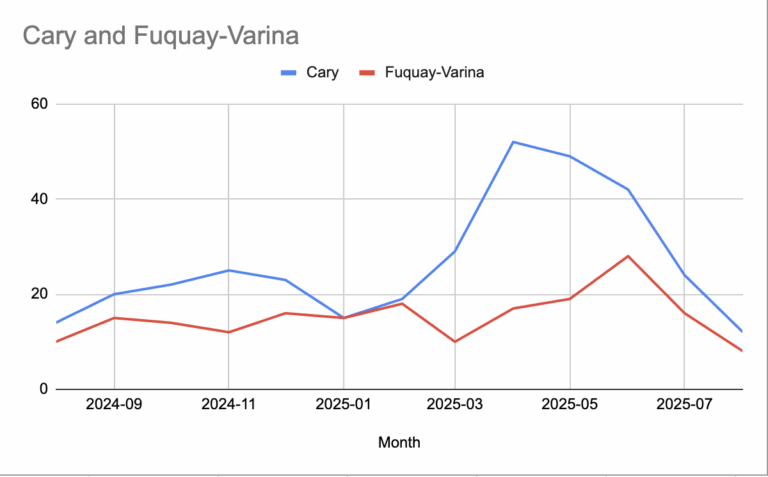

Remember that all markets are local, but right now Cary has 1.1 months of inventory , Raleigh has 1.9, Durham has 1.8, and Wake County as a whole has 1.7 months of inventory.

Right now it is still a seller’s market in most places, and I think it’s unlikely that we will see inventory increase enough to put downward pressure on home prices. People just don’t want to leave Raleigh and those who are leaving, are being replaced by a lot of people moving here.

If you like this article you might also like this one, where we analyze home appreciation in Holly Springs!