As a homeowner, you obviously want the highest price you can get when you sell your home.

But the best price is determined by how much you walk away from the closing table with, which doesn’t always correlate with the highest list price.

I know that doesn’t seem to make any sense, but stick with me and I’ll explain what I mean. First, a little tutorial on how the pricing process works:

During the sales process, buyers, sellers, appraisers and lenders all have a vested interest in the accurate pricing of your home. But the truth is, there might be some disagreement between the parties about what price is most appropriate.

Putting an exact number on probable sale price isn’t as easy as it sounds. When an agent or appraiser compares your home to other comparable properties (homes very similar in price, features and age, also called comps), that have sold very recently, unless you live in a neighborhood with very limited floor plans and features, a house almost exactly like yours simply doesn’t exist.

So we have to choose the homes that are most similar, and then make adjustments for the differences in features between your house and the comparable homes.

For example, if your home has 3 bedrooms and 2 bathrooms, and the comparable property (comp) has 3 bedrooms and 3 bathrooms, I would subtract the value of a bathroom from the price of the comp to give me a price your home would probably sell for.

It’s relatively easy to estimate the value of an extra bathroom or garage bay. It gets a little more tricky when the value of other features come into play. How much is an outdoor fireplace worth anyway? And what about a swimming pool? Or custom wood floors milled from a rare species of hardwood tree in Europe?

Are you paying attention? Because this next bit is important.

What it cost to build or install the pool, fireplace or custom floors in your home has no influence on it’s value. Value is determined by what a buyer is willing to pay for it, or more importantly, what a bank is willing to lend on it. Cost does not equal value.

How the Economic Principle of Scarcity Influences Home Value

Sellers sometimes mistakenly think that because they have a feature in their home that is rare, that automatically means it is of greater value. And scarcity is a basic economic principle known to drive up prices. However, the item must be both scarce and valued by the buyer pool.

Winter coats might be scarce in Florida stores, but that doesn’t mean they fly off the shelves when stores stock them.

The same effect applies to swimming pools in North Carolina. You don’t see them in many homes here, but then, not many people really want them so the value applied to them when selling a home is usually much less than the cost to install them. (So, if you really want a swimming pool, buy a home that already has one or take the loss when you sell your home.)

Sometimes sellers believe that, even though many people aren’t interested in their unique features, they just need the right buyer to come along, and then they will pay top dollar, because they want that rare thing so much. Unfortunately, what a seller needs to get top dollar is competition, not rare features.

Once your agent or appraiser has compared your home to other similar ones and made the adjustments, they will then have a price range in which your property will fall. For example, if I select 5 homes to compare your property to, and made the adjustments, each one of those homes likely sold at very different prices. I might tell you that your home will likely sell between $550k and $565k. That seems like a wide range. Of course, you want the higher price when you sell, right?

The price variations are determined by the following things.

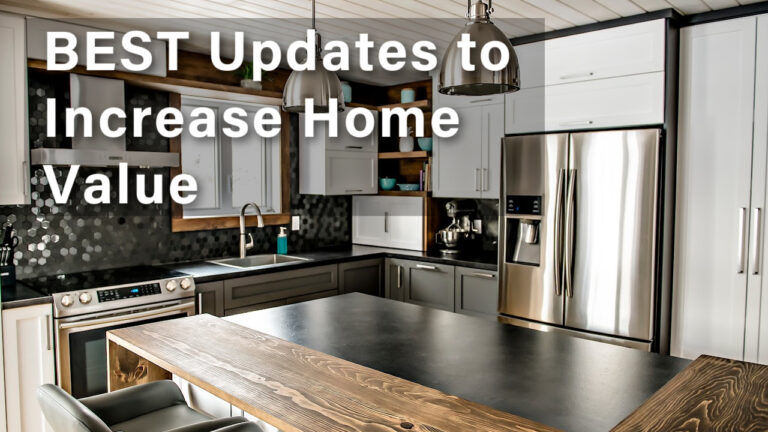

- Condition ~ Homes with similar features, will not sell for the same price if one home is immaculately kept and the other has an overgrown yard, and/or heavily worn or damaged floor and wallcoverings. Also, updating older homes to modern standards can have a positive effect on price.

- Features ~ While not all features are desirable in a home, there are also many features that make a home much less desireable. Or in other cases, if a home lacks a certain feature it will command a lower price. For example, a home with only 1 bathroom has a much smaller buyer pool than a home with 2 or more bathrooms and therefore will sell for less and likely take longer to sell than an identical home with 2 bathrooms.

- Micro-Location ~ Even properties in the same subdivision will have price variances based on proximity to through streets, backyard privacy, views, etc.

- Marketing ~ Marketing is what lets the world know that your home is for sale. If not enough people know, you won’t get the competition to get the best price. Beautiful photos, professional staging, appropriate pre-marketing, and wide-spread coverage through digital advertising all make the property more known to buyers and increase competition. However, even the best marketing can’t overcome a home that shows poorly due to distasteful smells, or being unkempt, or is priced too high.

How Could a Higher List Price Mean Less Money in the Seller’s Pocket?

This has to do with the psychology of marketing.

If your home is priced too high for the market, all the buyers that walk through your home will also be walking through similar homes that are the same price, but larger and/or with better (more desirable) features.

When they walk through the homes, what comes to mind is, “Why would I pay this much for house A, when I can get House B (bigger/better) down the street for the same price?”

And so other homes sell and House A sits.

And time goes by. It might not seem like a lot of time, but 2 or 3 weeks, is like a year in dog years in our current market. To buyers who are monitoring the market and know that the average home sells in 9 days…they start to wonder.

And new buyers come into play and they see that there are 10 other homes that just came on the market, going under contract, but this one isn’t moving. Why doesn’t anyone else want it?

Remember that idea of scarcity? Something similar is going on in this scenario.

And they start to think that homes like this are selling quickly, but this one is sitting. The seller must be desperate. And they start wondering how much of a discount they should ask for. That’s the first question every buyer asks when they enter a home that A) has been on the market longer than average or B) isn’t in move-in condition…which usually correlates with A.

Case in Point

These numbers change frequently, but an October 2017 report I ran for my area, Cary, NC in the Multiple Listing Service showed the following:

The properties that were priced correctly from the beginning sold for 3% more than the list price at the point of offer.

This held true for properties in ALL price points, from the $200k range to over $1 million.

The median list price in Cary when I ran this search was $350,000. That’s potentially a $10,000 loss to the seller. Do you think “testing the market” is a good strategy? Let me know in the comments!

Thinking about Selling? Check out Harmony’s unique strategy for getting the highest price for your home.

Don’t miss these great articles to learn more about the selling process from top real estate bloggers around the country!

Overpricing Your Home and the Disastrous Effects if Can Have by Kevin Vitali

Prevent Mistakes Selling Your Home by Wendy Weir

Top Ten Home Selling Mistakes to Avoid by Kyle Hiscock

and for some great home staging tips,

10 Easy Home Staging Tips by Sharon Paxson

[…] an overpriced home will stand out like a sore thumb. Ellen Pitts provides some insightful thoughts on how and why overpricing a home can lead to lost money. Homeowners need to pay particular attention to their pricing as no amount of marketing will make […]