Edited 4/25/2018: For January 1st Quarter Market Update CLICK HERE.

A few months ago I wrote about an increase in expired listings in Cary. At the time, I suspected that the increase was due to our collective nervousness about the upcoming presidential election. And it appears based on the 1st quarter 2017, that this assumption was correct. The increase in expired listings did not constitute a trend. First quarter numbers are as follows:

Cary 2015 Quarter 1 Expired Listings ~ 29

Cary 2016 Quarter 1 Expired Listings ~ 34

Cary 2017 Quarter 1 Expired Listings ~ 33

This shows a meager increase in expired’s from 2016 to 2017 of 3%, as well as a slight increase from 2015-2016. However, since our data sample is so small, let’s look at all of Wake County to get a better idea of trends:

Wake County 2015 Quarter 1 Expired Listings ~ 359

Wake County 2016 Quarter 1 Expired Listings ~ 335

Wake County 2017 Quarter 1 Expired Listings ~ 266

Wake County had a decrease in expired listings for the last 2 years and a significant 20% decrease in 2017, a good indicator that the housing market is still extremely competitive. But that’s nothing we didn’t already know.

Is it possible to know when the market will eventually turn?

Looking at past sales and expired listings is great information, but what would really be helpful to know is when will decline again. Fortunately, it is possible to know, with some degree of accuracy, when the real estate market will change.

Tio Nicolais, lecturer in real estate markets and investing at Harvard Extension School, explains that the real estate market, with few exceptions, has followed a historical 4-phase cycle:

Phase 1 – Recovery

Phase 2 – Expansion

Phase 3 – Hypersupply

Phase 4 – Recession

In short, once buyers absorb the existing inventory (Recovery Phase), builders respond to demand with new construction (Expansion Phase — the Triangle is currently in this phase), eventually overcoming the reduced supply. However, because there is a lag between satisfying market needs for inventory and ceasing construction, Phase 3 (Hypersupply Phase — evidenced by expired listings) is inevitable and always exceeds Phase 4, (Recession Phase).

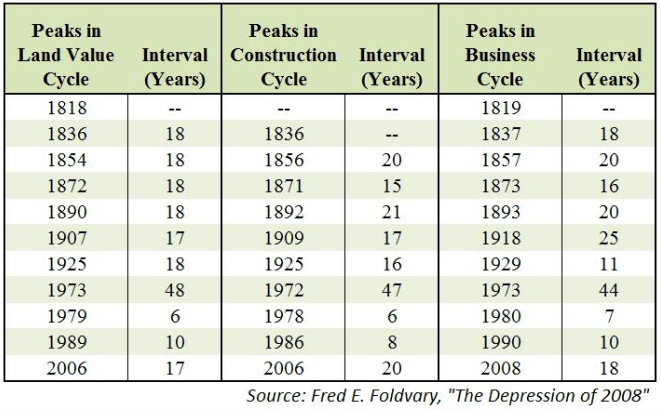

The chart below shows that the cycle of peaks and valleys are fairly consistent in the real estate market, with the typical cycle being 18 years from beginning to end. The two exceptions have clear causes: WWII and the Federal reserve doubling of interest rates to stem inflation in 1979. So we have fairly reasonable basis to suppose that unless there are major events that trigger an interruption of the cycle, we can expect an 18 year gap from the 2008 housing crash to the next one. Which will bring us to 2026.

Remember that 2026 should be the bottom of the market. We will certainly see signs leading up to it before it happens as expired listings again begin to increase. Don’t want to miss an update? Find the “Subscribe to the Harmony Blog” dialog box on the right hand side of your page and register to receive updates!

Ready to search for your new home? Wake County Real Estate Search