Should I Buy a Home?

While everyone’s situation is different and only you can truly answer this question, the information below will help you evaluate your own needs and your condition for your home purchase.

Before I begin, though, I want to state the obvious. I strongly support homeownership. But it isn’t just because I’m a Realtor. Home ownership has been a wonderful thing for my own family, and I have also seen it change many people’s lives for the better.

My husband and I were able to purchase our first home with no money down, using the VA Loan program available to him as a veteran. Buying that first home saved us a fortune in rent, which was hundreds of dollars a month more than our mortgage payment. Buying a home also allowed us to build equity at a time when we had very little money coming in during the early years of our careers. We even went through the economic downturn and had to sell a home at a bad time, but even including that difficult experience, homeownership has dramatically increased our financial profile.

Having said that, there are certainly times when owning your own home is not the best choice. You will find an excellent calculator below that can help you make a decision by looking at all the different pieces of the puzzle at your disposal.

I want to address the non-tangible benefits of homeownership, first:

>> A home offers the flexibility to live your life the way you want to without needing permission to add a pet to your family or build a garage or a fence or art studio for your projects. To some degree, homeownership is freedom.

>> You can decorate your home to your own tastes, and upgrade systems to meet your needs, rather than the bottom line of your landlord. A landlord doesn’t have much incentive to make your home energy efficient because s/he isn’t paying the utility bills.

>> The feeling of permanence, while not having a quantifiable value, is very valuable to many people.

And of course, there are also the tangible benefits:

>> While real estate markets do go up and down in the short term, homes are an investment that appreciate in the long term. Money you would spend each month on rent, in many cases, is better spent chipping away at your mortgage and increasing your equity, especially with interest rates remaining historically low.

>> In the Triangle in particular, rents are fairly high compared to mortgage rates and they continue to increase, while a traditional mortgage stays the same over the length of ownership. Unless you are only here short term, buying is almost always a better financial decision.

If you’re not sure if home ownership would be a better financial choice for you, you can estimate all the details on this comprehensive Rent vs Buy Calculator. This calculator takes into consideration home maintenance costs and average appreciation rates in addition to the increase in rental costs over time.

Mortgage Rates and How they Influence the Home you can Afford

Once you have decided to buy a home, you have to think about how you will afford it. For most people, the home mortgage is a necessity. Mortgage interest is the amount a lender will charge you for lending you the money to purchase the home. Mortgage interest rates fluctuate and have a significant impact on the price of home you can afford to buy.

Every 1% change to the interest rate

Is equal to a 10% change in home price

That means that if you want to buy a $350,000 home at 3.5% interest, if rates went up to 4.5% you could now only afford $315k. And if rates went down by 1%, you could afford up to $385k and still stay at the same monthly payment.

Rates have remained very low and fairly constant for many years now, but like everything in the financial sector, we don’t know how long that trend will continue. And interest rates are the one part of the equation that we have no control over. This calculator will give you a good idea of how much home you can be approved for, which is different than how much you can afford. Your comfort level with your payment, as well as your resources to address unexpected repairs, rather than the loan approval amount, should be the primary variables influencing home affordability.

Fast Fact: Experts recommend setting aside 1%-3% of the purchase price of your home per year for home maintenance and repairs.

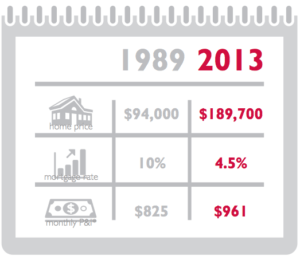

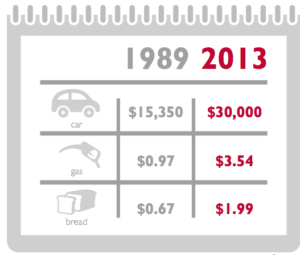

Affordability in Perspective

With prices on the rise, it can seem like homes are very unaffordable right now. However, the following graphics will put it into perspective. Even though they don’t take inflation into consideration, the principal and interest payment on a mortgage back in 1989 was close to where it is today. When you add inflation in, the difference is tremendous! Being a homeowner is well within reach of most Americans. As we saw above, in the Triangle, owning a home is much cheaper than renting.

[one_half_first] [/one_half_first][one_half_last]

[/one_half_first][one_half_last] [/one_half_last]

[/one_half_last]

You can use my interactive search tool if you would like to search for homes or you can contact me for more information via email or text or talk at (919) 725-1885