Mortgage Rates and How they Influence the Home you can Afford

There are a variety of online calculators that can tell you how much you can afford to spend when you purchase a home. But what happens if the rates change?

Mortgage interest is the amount a lender will charge you for lending you the money to purchase the home. These rates fluctuate and have a significant impact on the price of home you can afford to buy.

[Tweet “Every 1% change to the interest rate Is equal to a 10% change in home price .”]

That means that if you want to buy a $350,000 home at 3.5% interest, if rates went up to 4.5% you could now only afford $315k. And if rates went down by 1%, you could afford up to $385k and still stay at the same monthly payment.

Rates have remained very low and fairly constant for many years now, but like everything in the financial sector, we don’t know how long that trend will continue. And interest rates are the one part of the equation that we have no control over. This calculator will give you a good idea of how much home you can be approved for, which is different than how much you can afford. Your comfort level with your payment, as well as your resources to address unexpected repairs, rather than the loan approval amount, should be the primary variables influencing home affordability. Additionally many lenders recommend spending no more than 28% of your monthly income on a home, although there are programs that will allow higher percentages than that. Other financial experts say you should spend roughly 2.5 times your annual salary.

Fast Fact: Experts recommend setting aside 1%-3% of the purchase price of your home per year for home maintenance and repairs.

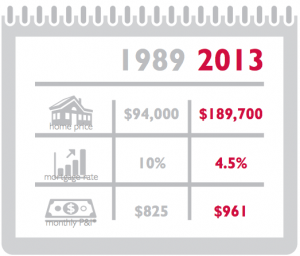

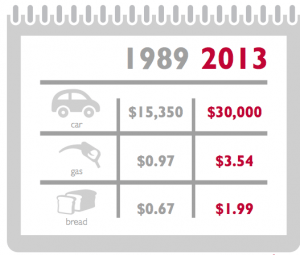

Affordability in Perspective

Even though the following graphics don’t take inflation into consideration, the principal and interest payment on a mortgage back in 1989 was close to where it is today. When you add inflation in, the difference is tremendous! Being a homeowner is well within reach of most Americans.[one_half_first]  [/one_half_first][one_half_last]

[/one_half_first][one_half_last]  [/one_half_last]

[/one_half_last]

Are you looking for an agent to walk beside you through your home purchase experience? Contact me for a free buyer consultation! You can send a message in the form below. Or call or text (919) 725-1885 [contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Phone Number’ type=’text’/][contact-field label=’Comment’ type=’textarea’ required=’1’/][/contact-form]

Ready to start your search for a new home? Wake County Real Estate Search

[…] Ellen Pitts How Mortgage Rates Influence Your Monthly Payment […]