Zillow is predicting a significant price increase in the housing market in 2024.

Robert Shiller, is not jumping on the bandwagon.

If you don’t know who Robert Shiller is, he predicted the .com bubble in the early 2000’s. And then in 2007 predicted the 2008 housing market crash.

While the internet and YouTube self proclaimed gurus go batty about a housing crash, Shiller says, it’s not happening.

Newsweek recently reported that Morgan Stanley is predicting that housing market prices will start dropping in 2024.

We’re going to investigate these predictions and then I am going to look at the three things everyone is ignoring about the housing market that is really at the root of all this mess.

It’s crazy because I haven’t read a single news article connecting these systemic issues to the housing market, but they are absolutely the foundation of this mess. We have got to address these things if we want to set this ship right again. But first let’s look at the predictions.

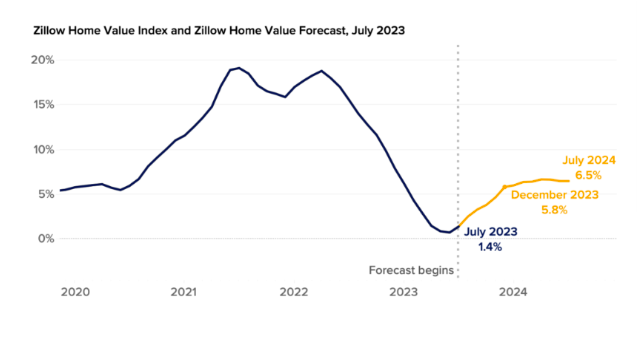

1. Zillow’s Housing Market Predictions and reasoning.

This is what Zillow has to say about the 2024 housing market moving forward:

“Just over half as many homes were listed for sale in July 2023 compared to the same month in 2019, and 29% fewer new listings entered the market in July than what was typical this time of year prior to the pandemic. This shortage has buoyed competition for the homes that are for sale. Homes that went under contract in July did so in 12 days – a week and a half faster than what was typical in 2018 and 2019. . . The tight inventory conditions and the persistence of elevated mortgage rates are also expected to continue to limit sales volume in the months to come.”

By the end of 2023, Zillow expects 17% fewer homes to have been for sale than in 2022.

2. Shiller’s housing market predictions and reasoning

Robert Shiller, while not predicting a crash, has a different take. He’s not saying there will be a crash… or a boom.

He is predicting a flatline.

Importantly, Shiller had this to say about the housing market:

“The housing market is different than the stock market. It’s normally forecastable. It has been growing since 2012. It has been about 10 years of steady growth in home prices. But it may be coming to an end with this interest rate rising cycle.”

Shiller believes the 2-3% rates were what drove the housing market exuberance. Buyers knew those conditions wouldn’t last long. So they jumped in. The rates went away and the buyers evaporated with them. But so did the sellers. Just stop for a minute and imagine what would have happened in the housing market if rates remained at 4-5% and just held steady throughout the last 3 years?

Could we have avoided all this insanity?

3. Morgan Stanely’s housing market predictions and reasoning.

Analysts at Morgan Stanley expect home prices to remain flat for the rest of 2023. And then they expect a 2% drop in 2024.

Markets are Local

One thing to remember with all these national reports is that real estate markets are local. Every town and city is going to experience the real estate market in a different way.

Some cities in the US are experiencing very slow markets, but some are still very hot.

According to Wallethub, out of the top 15 best cities to buy a home right now, 5 of them are in Texas and 3 of them are in North Carolina. The 3 North Carolina cities happen to be in my market, Raleigh, so I can tell you that even within a metro area, some cities are super competitive and some aren’t competitive at all.

There are places in my market where bidding wars are still very common and it’s difficult to get an offer accepted. There are other towns in my market where the majority of listings have no competing offers at all. It just depends on where you are both nationally and within a metro area.

What’s really going on and how do we fix this mess

But let’s talk about the elephant in the room.

What is actually CAUSING all this market instability?

Prices are high and most economists aren’t expecting prices to go down much. But no matter where I look or what I read, I’m not seeing anyone talking about the underlying issues that from what I can see, appear to be the CAUSAL factors in the housing market being so jacked up. And if we’re not talking about them we can’t fix them.

All everyone talks about is numbers. housing prices, inventory number and interest rates.

And those are a useful way to see that the market is out of control.

But it doesn’t tell us why.

Behind every number is HUMAN BEHAVIOR causing the numbers to do what they are doing. And that is what we have to change if we want a normal housing market where the average person can afford to buy a home.

Let’s look at 2 issues I think are really driving this mess. There’s probably more than two, but these two are on my mind because they are part of the supply and demand problem that no one seems to be talking about.

1. Americans are demanding more homes to be built for fewer numbers of people.

The number of Americans living alone has skyrocketed.

In 1940 7% of Americans lived alone. Today, almost 30% of Americans live alone.

If we look at this in terms of the ratio of homes needed for the same number of people, it’s stunning. If the same percentage of people lived alone today as in 1940, we would need 25 million houses for our current population. But at the rate of Americans currently living alone, we need 91 million houses for our current population. That’s an extra 66 million houses.

But it gets crazier. We are averaging construction of about 900,000 homes per year. At that rate of construction, that’s an extra 73 YEARS that it would take to build those homes!!!!

It isn’t just that our population has grown in general, we are wanting higher ratios of home to people than we’ve ever had before. This makes our supply problem even worse. There seems to be an expectation that a single, typical salary should be able to afford a single family home. I’ve heard people say that’s how it used to be.

Breaking down the numbers

But let’s actually break down what that means.

It takes roughly 32 workers 3-4 months of labor to build a typical home.

That’s not including drawing up the plans or any engineering or project management. This is just regular construction workers and if those workers earn the average annual income of $33,000 that right there is 300,000 dollars. Now add in the cost of materials about 150k. Now add in the land and development cost, assuming you want a driveway and any land clearing and connecting to utilities. We’re over $500,000 for a basic house.

I know that today is a lot different than 1940, but the reality on the ground is that we might be asking for more than we can reasonably expect to get. Ultimately market prices are controlled by supply and demand, and the demand is just outstripping supply by a lot.

There is no getting around this. I genuinely don’t think we will be able to keep up with home construction if more people don’t live communally. But it’s also not the only CRAZY thing impacting the housing market.

2. Home Construction is decreasing

Not only is the demand for homes astronomically higher by population, Home construction has fallen by 55% since 2006.

Right now the US is short 6 million homes.

This is happening for a few reasons. First, after the 2008 crash a lot of builders went out of business. Second, the data for construction workers is very concerning: A report from the Associated Builders and Contractors had this to say:

“With nearly 1 in 4 construction workers older than 55, retirements will continue to whittle away at the construction workforce. . . Many of these older construction workers are also the most productive, refining their skills over time. The number of construction laborers, the most entry-level occupational title, has accounted for nearly 4 out of every 10 new construction workers since 2012. Meanwhile, the number of skilled workers has grown at a much slower pace or, in the case of certain occupations like carpenter, declined.”

An underlying reason for worker shortages

We’re just not replacing the construction workers that are retiring.

But there’s a deeper reason we’re not doing that.

Public schools used to prepare students fairly well for the construction trades. But as educators noticed that lower income students were more likely to go into the trades, they shifted the public education system to primarily be a college directed program, pushing everyone into a college track.

While it’s definitely a good thing that class divisions are less likely to keep one from attending college, the bad thing is that many public school students don’t feel that they have any other options. So those who don’t want to go to college, spend years in a school system that doesn’t really meet their needs.

94% of construction workers are male.

Men have much higher dropout rates than women.

I think these things are all connected.

I think if we can shift the school system and give the students more say in what they want to do, not force academic work on kids that aren’t inclined to do it, AND to provide other alternatives, I think it would have a big impact on the housing market.

Ultimately, we need to make the decision to either go to college or go into the trades based on personal preference, not class. But it SHOULD be the student’s decision.