Greater Wake County vs Cary/Apex/Morrisville Market Update.

For the 1st Quarter 2018 Market Update CLICK HERE. (You’ll love the newly updated, easy to read format!!)

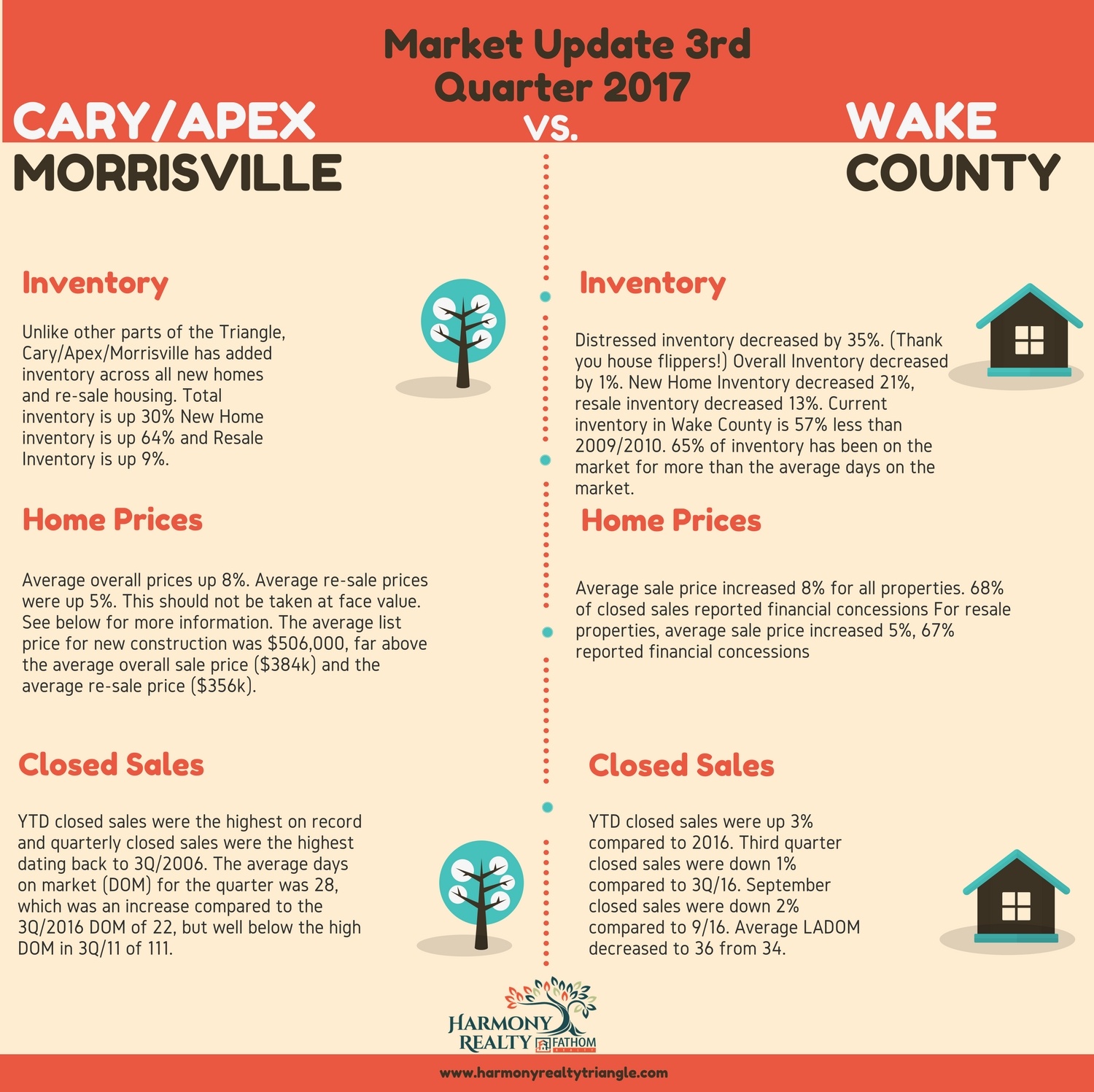

I thought it would be useful to do a comparison of the market update in Wake County overall compared to the Cary NC housing market (including Cary, Apex, & Morrisville). When you look at Cary’s numbers and compare them with Greater Wake County, you can see how unique and specific the Cary market is.

Remember these metrics take into account the seasonality of the Raleigh housing market by comparing the current period to the same period in the previous year.

Scroll down past the infographic for my analysis of the data.

Wake County Housing Inventory

There is a clear difference between housing inventory in Cary/Apex/Morrisville and Greater Wake County. In Cary/Apex/Morrisville inventory is increasing, but in Greater Wake County inventory is still decreasing. An increase in inventory generally signals a market shift towards becoming a buyer’s market (in a seller’s market.) If the market was already a buyer’s market it would indicate an even stronger market for buyers.

I still believe that it’s too early to tell if this is truly a shift in the direction of the market in general (in Cary & Apex) or a short blip that will adjust itself. It’s also important to note that these are average numbers for all housing. We are still seeing a lack of inventory in homes priced under $400,000.

Having said that, as I wrote this post, I ran a search in the MLS for properties less than $400k in Cary. There are 270 properties on the market in Cary right now under $400k. 111 (41%) of those properties have been on the market for more than a month. The median Days on the Market is only 7 days, yet over 40% of properties currently listed in the most desirable price point have been on the market over a month. What’s going on?

First let’s take a look at the inventory to get an overview…

Cary NC Housing Market (including Apex & Morrisville)

The Cary NC housing market has added inventory in both new homes and re-sale housing. Total inventory is up 30%. New Home inventory is up 64%. Resale Inventory is up 9%.

The inventory shortage under $400,000 is what has been driving the prices up, because many people are competing for few homes. The inventory shortage has also been limiting the number of closings, because some buyers have dropped out of the market without purchasing due to the competition. So the increase in inventory is actually a good thing. The increase is giving us a more balanced market where buyers in the market are actually able to buy the homes that sellers want to sell.

Also, the available housing inventory has a direct impact on how long it takes to sell home. We use that metric to determine whether we are in a buyer’s market or a seller’s market. If you look at the chart below, you will see that, generally speaking, the months of housing supply (MOS) increases as the price of the home increases. When that MOS reaches 6 months, it is considered a buyer’s market.

In Cary: Properties under $400K remain in a strong seller’s market. Properties between $400K and $500K are still in a seller’s market, though not as strong of a one as below $400K. Between $600 and $800k it is barely a seller’s market. We are approaching a buyer’s market in that price range. Homes above $800k are already in a buyer’s market.

Apex is similar, however, in Apex properties between $800k-$1million are still a decent seller’s market with limited inventory. Although properties over $1 million are taking twice as long to sell in Apex as in Cary.

In Morrisville (this is actually a combination of Morrisville and West Cary) remains a strong seller’s market for all properties under $800k and continues to be a seller’s market up through $1 million homes. However, don’t miss the interesting dynamic about financial concessions below….

Wake County

In Wake County as a whole we still have decreasing inventory, which is a sign of a strong seller’s market, which is a different picture from what we’re seeing in Cary. I think this is a direct result of the price of housing in each location, which I’ll address in a minute.

Wake County Real Estate Pricing

The biggest surprise from the current pricing data is that even though prices are up, the number of sales with financial concessions is not consistent with a seller’s market. More info below…

Cary NC Housing Market Pricing

Average overall prices in Cary/Apex/Morrisville were up 8%. Average resale prices were up 5%. There is a tendency to think that home prices are rising too quickly. To get a better idea of what is happening in the market, we can compare this year’s 3rd quarter numbers to the previous highest 3rd quarter, which was 2009. This analysis shows a distinct difference between the two sets of data. Specifically, 69% of closed sales in 3rd Quarter 2017 received financial concessions, which was not common in 2009. Financial concessions are not characteristic of a seller’s market.

And here’s the thing…

Because financial concessions are not characteristic of a seller’s market, the concessions we are seeing today may indicate a 1-2% difference in the actual percent increase of value compared with the observed increase when looking only at sales price without financial concessions.

When we take that information into consideration with inventory data above, we see that…

We might be in a seller’s market in which many buyers can’t actually afford to pay the going rate for housing. Lots of buyers want to buy. But they can’t afford the prices. And it makes a lot of sense.

Financial advisors recommend spending no more than 2.5 times your annual income on housing. Even in Cary, where the median household income is $91,000, that would mean the majority of families in Cary should be buying homes for around $227,500. But the median sales price in Cary is $342k. And there is very little inventory in that price point available.

The average list price for new construction is $506,000, far above the average overall sale price ($384k) and the average re-sale price ($356k).

Here’s what I think…

We know four important things:

- Prices are up, but it appears (considering the magnitude of financial concessions all over Wake County) that the price increases should not be taken at face value.

- Inventory is increasing in Cary, Apex & Morrisville and decreasing slightly in Greater Wake County

- Prices in Cary/Apex/Morrisville, traditionally considered the most desirable location in the county are significantly higher than prices in Greater Wake County.

- Even in the hottest Cary Market with the least inventory under $400k, a large percentage of properties are sitting on the market longer than expected.

But there is one more piece of the puzzle we’re missing

5. With median re-sale homes in Cary Apex Morrisville selling in the mid-$300k price range and new homes starting at $275k for condos and $400k for detached single family homes, there is only so far that re-sale prices can rise before buyers will be unable to afford the existing homes for which there is so much competition. If builders are able to find a way to meet the need for affordable housing under $400k consistently, likely with attached housing such as condos and town homes, we may be at the beginning of a shift seen in larger cities toward attached housing being a staple in our market.

Indeed, over the past 10 years, there has been a 32% increase in attached housing sales in Cary/Apex/Morrisville.

In the rest of Wake County where homes are still more affordable, there was a 27% decrease in attached housing over the same time period.

Stay tuned…

Follow me on Facebook if you want to be informed, entertained and inspired. Harmony Realty… Helping you to live well in the Triangle.

*All statistics taken from T.A.R.R Report